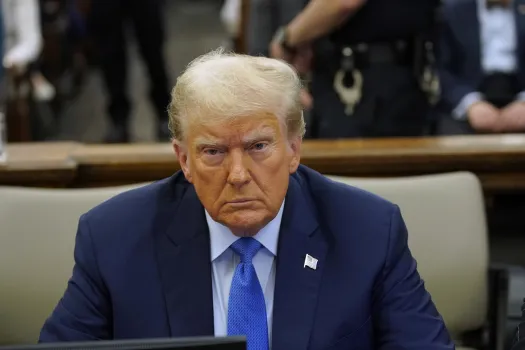

Donald Trump New York fraud ruling struck right where it hurts the most.

The most recent legal setback for Donald Trump strikes at the core of his being, challenging his entire persona.

He has been marketing himself for decades as a brilliant businessman who succeeded in one of the most competitive cities in the world.

That image—always linked to New York deal-making and strengthened by unrelenting self-promotion—launched him into global prominence and enabled him to remake himself as the president of the United States and a reality TV star.

However, Mr. Trump’s entire narrative is called into question by Judge Arthur Engoron’s decision in a civil fraud case, which is connected to the inflating of property values and falsifying on financial statements to secure better loan conditions. Rather, it portrays him as a phony and deals a severe damage to his money and business empire.

One time, Donald Trump said that the power of the mind can overcome any challenge. But what a barrier that is.

The ruling substantially restricts the Trump Organization’s capacity to conduct business in New York. For a period of three years, he has been prohibited from holding any directorships, and his company is also unable to obtain loans from financial institutions that are registered with the city during that time.

A massive $355 million (£282 million; €329 million) financial penalty has been imposed against him; when interest is included, the amount rises to almost $450 million, well exceeding his available funds. His company will remain under independent oversight, with a different independent director of compliance approving significant business choices.

One possible silver lining for the outgoing president and Republican front-runner could be that the Trump corporation avoided the corporate death penalty by having its business licenses revoked.

For many years, Mr. Trump has been able to move beyond scandals and legal difficulties that may inflict irreversible harm to others. In fact, he has been dubbed to as Teflon Don because nothing seems to cling to him.

John Gotti, the mob boss, was the former owner of this nickname following his high-profile acquittals in the 1980s. However, the ruling today suggests that, similar to Gotti, Donald Trump’s good fortune might be running out.

The judge, Engoron, took note of the defendants’ history of repeated and persistent fraud as well as Mr. Trump’s lack of regret. He claimed that the instances of fraud at the organization spanning more than ten years “leap off the page and shock the conscience” in this particular instance.

He claimed, however, that the defendants were unable to acknowledge their mistakes and wrote, “Their complete lack of contrition and remorse borders on pathological.”

Not unexpectedly, Mr. Trump has a totally different perspective. Rejecting the idea that he should face consequences for his deception, he claims to have created a “perfect company” and the banks were fairly compensated. He keeps saying, devoid of proof, that elite Democrats are merely using his legal battles as a ruse to prevent him from winning the presidency.

Mary Trump, the estranged niece of Mr. Trump, believes that the judge’s decision means the Trump family heritage is over. “Today is an emotional day, but one thing is for certain: the Engoron decision is absolutely devastating for Donald,” she posted to social media.

Mr. Trump always envisioned himself amid Manhattan’s skyscrapers, having grown up the son of a real estate developer whose ventures included middle-class apartment buildings in the boroughs of Staten Island, Queens, and Brooklyn.

A seven-year building boom from 1976 to 1983, which included the Trump Tower, cemented his position as New York’s most powerful real estate developer. He implied that he had already escaped his father at the age of 37 when he told the New York Times in 1983, “Not many sons have been able to escape their fathers.”

It’s also true that for a young developer with his aspirations, the decade of excess and greed in the 1980s was prosperous.

Trump Tower’s prominent placement on Fifth Avenue helped to establish Donald Trump’s reputation. After establishing his notoriety, he signed his name to all of his projects.

However, Donald Trump filed for multiple corporate bankruptcies in the early 1990s and almost lost everything.

During this time, Mr. Trump and his business collaborated with Rich Herschlag, the top engineer in the Manhattan Borough President’s office, on the Riverside South project, which involved redeveloping an abandoned train yard on the Upper West Side.

According to him, it took “everything or damn close to everything” for Donald Trump to establish himself as a prosperous real estate developer and, in particular, to create an empire based on his father’s history.

“To watch it [potentially] gutted and decimated, I can’t image that’s anything less than an emotional horror,” he stated to the BBC.

It’s still unclear how Mr. Trump plans to pay the roughly half a billion dollars he owes, and whether selling any properties or ventures to raise the money will be necessary. Forbes values his vast New York real estate empire at $490 million, but he owns numerous other properties across the nation, including hotels, golf courses, condos, and even a winery.

He intends to file an appeal against the punishment, which will halt the ruling until a higher court has had a chance to consider the matter.

However, he still needs to deposit the entire sum within 30 days or obtain an expensive bail if he wants to avoid paying the fine or having his personal assets taken while the appeal procedure is ongoing.

The former president would consider it an embarrassment to sell any of his valuable real estate in Manhattan, and he would not make this decision lightly.

Regardless of whether Donald Trump is able to bounce back from this financial setback, the result is certain to severely damage his wealth.

It is certainly a major loss for the ruling class in the city where he attained prominence despite constantly feeling like an alien. And when it comes to New York real estate, Mr. Trump has mocked no one more than the “loser” for more than 60 years.

Credit of information: This in depth article originally published by respected “BBC”

If the original publisher has issue with this article, please feel free to reach us at director@amedra.in for removal of this article.